Optimize your small case with Capital Overflow

Strategy

Timeless Quantitative Methodology

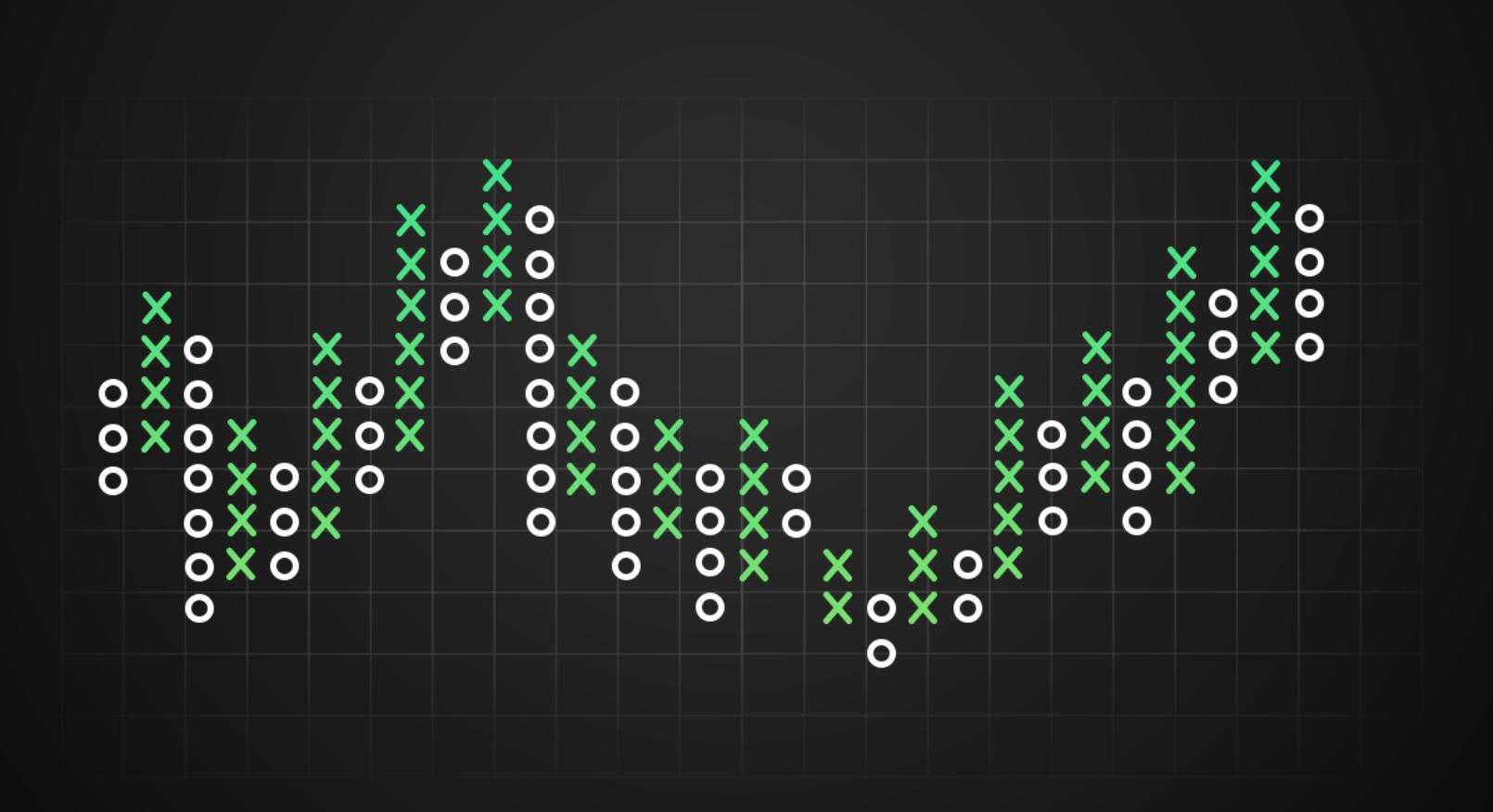

We use Point-and-figure charting exclusively for the technical analysis of the security. Breakouts can signal major trend changes. Due to timeless nature of the methodology, it confirms signals provided by traditional chartss to avoid false breakout.

Foundation

Irrefutable Law of Supply and Demand

Instead of relying on those TV news or breakthrough Chat GPT level AI technology, we stick to the basics of Economics-101. If there are more buyers than sellers willing to sell, the price must rise and vice versa. Embrace the simplicity of this because it is all there is.

Portfolio

Learn to invest the right way and maximize your investing potential

Ensure your Portfolio stays on course

Explore investment portfolios designed to optimize returns while managing risk

smallcase

Arctic sea ice minimum

Average September extent. Source: NSIDC/NASA

smallcase

Arctic sea ice minimum

Average September extent. Source: NSIDC/NASA

smallcase

Arctic sea ice minimum

Average September extent. Source: NSIDC/NASA

Tools

Additional tools to help you determine the portfolio that best fits your investment style

Newsletter

Get market insights and facts for wealth creation right in your inbox

Join thousands of readers of our weekly newsletter and other updates delivered to your inbox and never miss on our articles